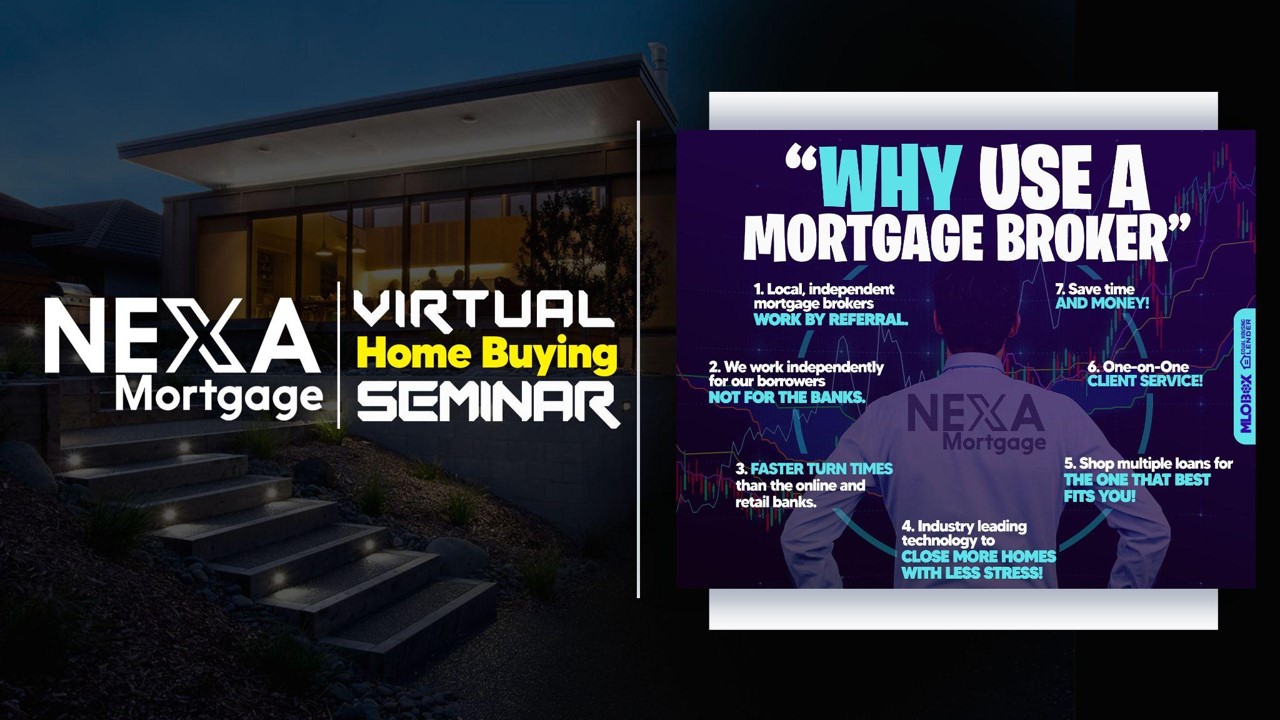

Banks Fight For Your Business

As brokers, we shop your scenario with 30+ lenders to get you the best rate.

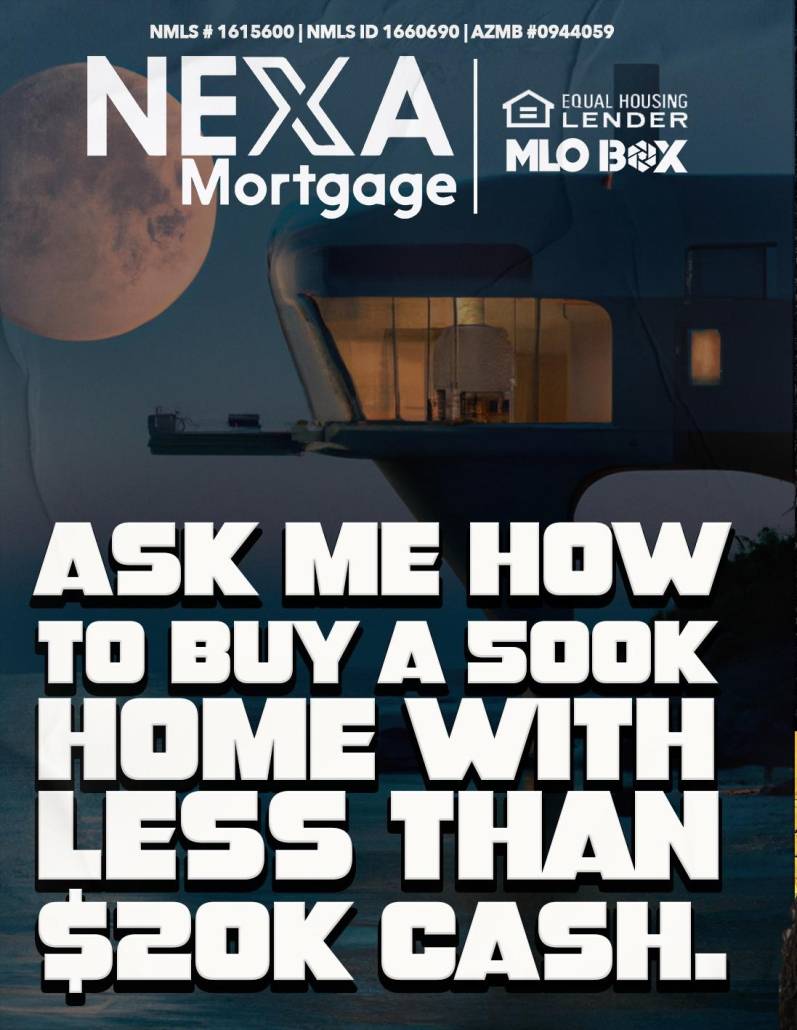

No Lender Fees

We don't charge any lender fees, saving you on average $1,600 over retail banks.

Won't Impact Credit Score

We make sure the numbers work before running your credit.